Insurance Apps: Learning from the Best Apps on the Market

UI/UX Design

App Development

When it comes to insurance, there are masses of supplier options to consider. Whether it’s cover for tech, a car, a property, or anything else important to the policyholder, the competition between providers is fierce.

According to Econsultancy, 85% of consumers prefer to use an app over a mobile website. To help your insurance company stay ahead of the curve, we’ve investigated five of the top-performing insurance apps in the market to present you with learnings on why they work so well, what makes them stand out and what could be improved.

Geico

Geico (Government Employees Insurance Company) is one of the larger insurance companies, providing car insurance to millions of drivers across the United States. The app dashboard ensures the most valuable data is displayed upfront, such as the ‘Emergency Roadside Service’ which is sensibly prioritised. Other information that is less likely to be needed as often is available through the hamburger menu. In doing so, they have effectively avoided cluttering the interface and information overload.

4.8 starred with 751K Ratings

Founded in 1936 and based in the US

Looks to be the ‘friendly and affordable insurance company

They provide insurance on all aspects, not just automotive

PROS:

No clutter

Encapsulates everything users can do through the desktop site

10 additional features that extract pain points for the user (i.e. parking locator and gas finder)

Easy to use

Colours and design consistent with the overall brand

Simple and colourful, keeping information clear and concise and easily accessible

One of the most used apps

CONS:

Long login process, requiring a lot of details

Buttons too close to other content

Overall, the app appears almost faultless in its execution. Visually, it looks great and the usability has been clearly thought through to ensure the user's needs are at the forefront of the app’s functionality. Hierarchy has been established to guarantee significant data and components stand out to the user, saving them from any inconvenience.

Liberty Mutual

Liberty Mutual is another large insurance company that offers an app to its customers with a respectable 4.8 stars from 19,500 reviews in total. Providing auto, property, life, accident, critical illness, identity theft, pets, tuition and small business insurance, Liberty Mutual aims to be there for its customers while they’re on the go, with a fully functional app that allows them to review their policy and submit a claim.

4.8 starred with 19.5K Ratings

Founded in 1912 and based in the US

Looks to be a friendly and affordable insurance company

They provide property and auto insurance

PROS:

Additional features that extract pain points for the user (i.e. tap to call for roadside assistance, report and track claim, upload images of damage)

Manage account and policies

Illustrations

Clear and concise

CONS:

A restricted colour palette, no distinguishing factor to the elements

No emphasis on the roadside assistance feature

Overall, the app appears intuitive and offers the required features needed for users to manage their insurance in an accessible way. The app could be tweaked visually to improve the hierarchy a little more, however, it could be argued that the important elements will differ between users.

MyAviva

Aviva is one of the largest insurance companies in the UK and Canada, providing around 31 million customers with insurance, savings and investment products globally. They are the UK’s largest insurer and one of Europe’s leading providers of life and general insurance. Aviva offers an app to its customers with a concerning 2.9 stars from 120 reviews in total. However, from a glance it’s notable that a lot of the reviews mention problems logging in, and so this could be related to front-end issues and not the usability of the app itself.

2.9 starred with 120 Ratings

Founded in 2000 (by merger) and based in the UK

Highly rated insurance

They provide property, auto, life/health and travel insurance

PROS:

Basic, clear information efficiently condensed

View policies and start a claim features

Colours are in-line with wider branding

CONS:

Support tool as opposed to providing additional features to the main desktop website

No extra or app-exclusive features

Does not retract the need to use the website

Overall, the MyAviva app provides a faster way for customers to access their policies and start a claim, but other than this there doesn’t appear to be any further or superior features. It seems the app may not have been marketed extensively to users, and that Aviva are simply offering another platform for customers to access Aviva.

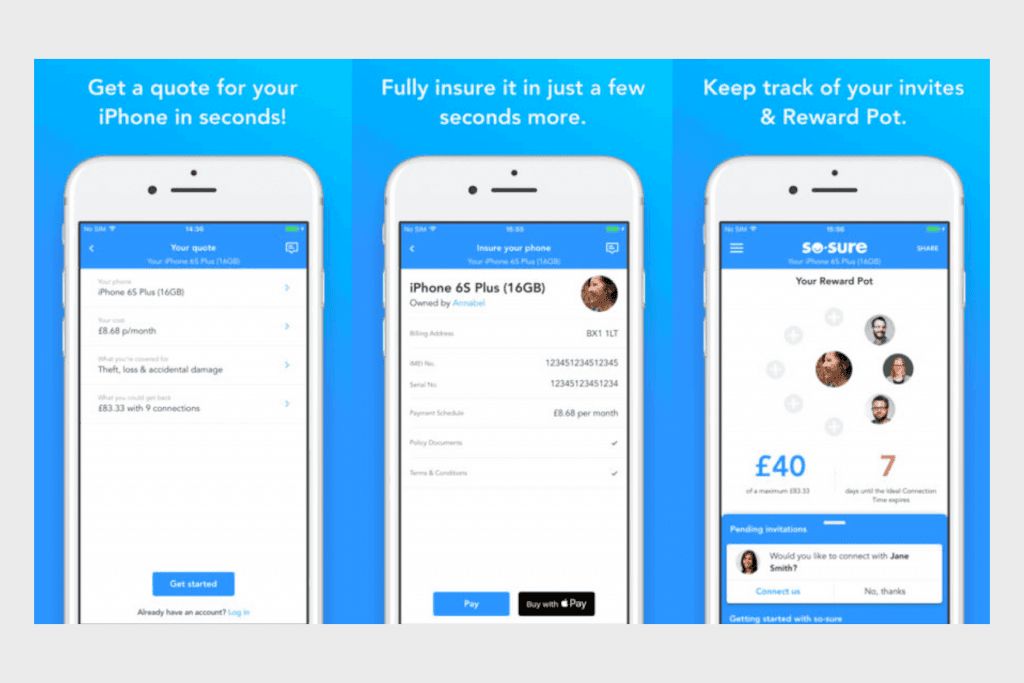

so-sure

so-sure is a UK-based insurance app that allows users to take out mobile insurance policies. so-sure offers a rewards scheme, where users can earn rewards for inviting others to use the service and if they don’t make a claim. Founded in 2014, the business has received £150,000 in funding, and although the reviews aren’t viewable on the Apple Store, they have a 7.7 rating on Trustpilot from 51 reviews.

Hidden reviews on Apple Store

Founded in 2014 and based in the UK

so-sure provides mobile phone insurance

PROS:

‘Reward pot’ feature (each time a user connects with a friend, both users receive up to £10. Users can connect with as many friends as they like until their pot is worth 80% of their premium)

Connecting with friends is easy and simple

Relevant information is shown in an easy-to-access way

Speedily resolve claims within 24-72 hours through the app

CTA’s highlighted and prominent

CONS:

Plain design

The old version of the ‘reward pot’ screen appeared more user-friendly than the update

Overall, so-sure has found a unique way into the market and become a big startup name. They have recognised something that previously has not been executed well within the industry and carried it out better than the competition. Although they boast these features, they still manage to offer policies cheaper than their competition by up to 40%.

Kinsu

Kinsu is a UK-based Insurtech company distributing via a tech platform. They offer monthly coverage for phone, laptop, tablet, headphones, cameras and any other high-value items the user would like to take a policy out for. Kinsu’s policies work on a rolling monthly agreement that can be cancelled at any time should the user wish to, without being locked into a contract. With such a crowded market within the Insurtech industry, Kinsu has tried to stand apart and provide a ‘kinder’ approach to insurance service delivery.

4.8 starred with 66 reviews

Founded in 2016 and based in the UK

Kinsu provide insurance for personal belongings

PROS:

Cancel anytime through the app

No ‘jargon’ – insurance policies are no longer than 12 pages

States within the app what the user is and isn’t covered for in an easy to access way

Transparent language, no grey areas

Streamline the process through the app and remove pain points for the user

Stripped back process, only presents the necessary information

Clear and attractive colour scheme and design

The Kinsu app has a really strong proposition and seems to be a big contender in the Insurtech market. They have seen where the disconnect is between people and insurance, and have tried to improve this with their easy-to-access service that takes out the complicated legal language typically associated with insurers.

Our Thoughts

So, with the above apps and the pros and cons that come with each of them in mind, here are the key learnings we feel insurance companies should take when introducing their own mobile application:

Exclusive Features

Having an app that differentiates itself from the standard desktop site is important to encourage users to download it. It needs to offer something that the website can’t and help to make the life of the user simpler when it comes to the product that they have insured. What makes your app stand out from the competition? How can you help your users to get the most from your service?

Simple and Transparent

Avoiding jargon seems to be a key theme throughout, ensuring that the legal side of things isn’t over-complicated and keeping the app as straightforward as possible. Users go to the app for ease of experience and so it’s important to make the language used easily digestible for all.

Intuitive Design and Ease of Use

The use of strong call-to-actions and colour coding is important to engage the user and help them seamlessly navigate the app. Place priority systems more prominently than less important features and don’t add too many pages/screens.

Remove Pain Points for the User

Your app should take problems away from the user, acting as a solution for whatever they may need, whether that is roadside assistance for their car or to report damage to a piece of tech. How can you go the extra mile? Are there any other services you can provide through the app?

No Unnecessary Features

As much as you should have extra features that can make a real difference to the user, it is important not to overload the app with too many things to see and do. Don’t create features for the sake of having something unique, if it isn’t going to add value for the user then it will simply make load times slower and serve little purpose. Put thought into your app, research your target market and gain an understanding of what features they could put to good use.

Why is the app Better than the Desktop Site?

Aside from the added features, why is downloading the app beneficial to the user? Why is it different to the desktop website? The answer to this is usually speed and accessibility factors, so with this in mind, how can you save your users time and make it easy for them to access your service? Speed dial buttons to call your company and the ability to quickly and efficiently report a claim through the app without speaking to anyone are great places to start.

Branding and Design

The design should be clear and keep consistent with the colour scheme of the brand as a whole. This positions the app as familiar territory for users and will resonate with them on a more personal level. The call to action should stand out clearly with buttons and the use of colour and images to help users navigate the app and access the required feature with ease. Ensure that images and buttons are used sparingly, but where relevant. Avoid bunching text close together and over-cluttering – there should be sufficient ‘whitespace’ to make it easy on the eye.

Got an idea? Let us know.

Discover how Komodo Digital can turn your concept into reality. Contact us today to explore the possibilities and unleash the potential of your idea.

Sign up to our newsletter

Be the first to hear about our events, industry insights and what’s going on at Komodo. We promise we’ll respect your inbox and only send you stuff we’d actually read ourselves.