Top 5 Digital Banking Apps In The UK

UI/UX Design

App Development

The last few years have witnessed a surge of new Fintech companies and Digital Banks all seeking to innovate in a previously static sector, whilst also capitalising on the growing expectations of the digital consumer. This is of course great news for us, the consumer, as we now have so many great options and services to choose from. What’s more, if we aren’t happy with the one we choose, it’s easier than ever to switch to another banking supplier.

So who could we choose? Who, in this competitive space, does it best?

The rest of this article is going to focus on exactly those questions. It’s going to evaluate 5 of the best Digital Banking Applications on the UK market to date. Whilst some of the services they offer differ, the primary concept of providing real-time financial services through an intuitive mobile application holds true to them all.

As such the evaluation, will focus on the same key criteria for each provider:

What services do they offer?

How do they score in their reviews?

What is their stand out feature?

How could they improve their offering?

Please note it is not therefore the purpose of this article to explain the more generic advantages (real-time notifications etc.) and differences of these offerings in relation to more traditional banking options.

So, let's jump right in!

Starling Bank

Starling Bank received a banking licence in July 2016 and launched the UK's first app-only current account in March 2017.

They have now opened 1.25 million accounts, including more than 100,000 small business accounts. Equally impressive, the bank has been crowned best British bank and best current account provider at the British bank awards in 2018, 2019 and 2020.

Services they offer:

Personal, joint, Euro and business current accounts

Interest on current account

Overdrafts

Compatible with Apple and Google Pay

Mobile cheque deposits

Savings goals & round ups

Personal and business loans

Desktop features for business accounts, enabling them to view and export statements to CSV or PDF and save them straight to their desktop

Cash deposit and withdrawals through the Post Office (charges apply)

Starling Bank Marketplace allows users to sync their bank account with third party services such as Churchill or Habito, thus centralising all of your financial products in one place

Fee-free spending or withdrawals abroad

Regulated and authorised by the FCA and FSCS up to £85,000

Reviews:

11,378 reviews on Trustpilot. Excellent (77%) and Great (11%) account for 88% of the votes.

App Store: rated 4.9* from 102k reviews

Google Play: rated 4.8* from 28k reviews

User experience:

As you would expect based on the above reviews, the overall user experience throughout Starling’s app is cracking. I agree with the thousands of users who have commented on the UI/UX of this application. It is easy to navigate, feature-rich, making your spending/banking data clear, insightful and actionable at your fingertips, as opposed to just some historic numbers on a sheet of paper.

The flexibility to personalise elements of the application is also worthy of mention, such as personal images for accounts and goals.

Standout feature:

Mobile cheque deposits: Starling Bank is the first of its kind to enable users to deposit cheques up to an amount of £500, using nothing but their smartphone.

All users need to do is navigate to the option within the app, take a photo of the app and submit. Job done.

This is a shining example of how an application can combine simple navigation with the device's capabilities to save the user time - and on this occasion - a tedious trip to the bank.

Potential for improvement:

Like in all parts of life there is always room for improvement and in Starling Bank’s case, if pressed, it appears the speed of customer service and, more significantly, the negative impact caused by glitchy updates are the common denominators. A recent user recently left the following review on Google Play: “Another app update and a new set of problems. Enough is enough. Switching away today.”

I feel there is also an opportunity for Starling Bank to incorporate more of their brand’s vibrant colour palette throughout the application as opposed to just the home screen.

The good news is that these challenges are completely fixable.

Summary:

When it comes to Starling Bank, their reputation says it all. Winning the award for Best Current Account three years running doesn’t happen by accident and their user reviews fully echo this, with 88% of their users stating their overall experience as great or above.

Looking more specifically at the face of their customer engagement in their apps, they can boast an average rating of 4.85* across both platforms. This rating is supported by wades of comments testifying about how easy to use and intuitive the UX/UI of the application is - vital for a digital-only provider.

It will be interesting to see if Starling Bank is able to push its offering even further by addressing the two denominators mentioned above.

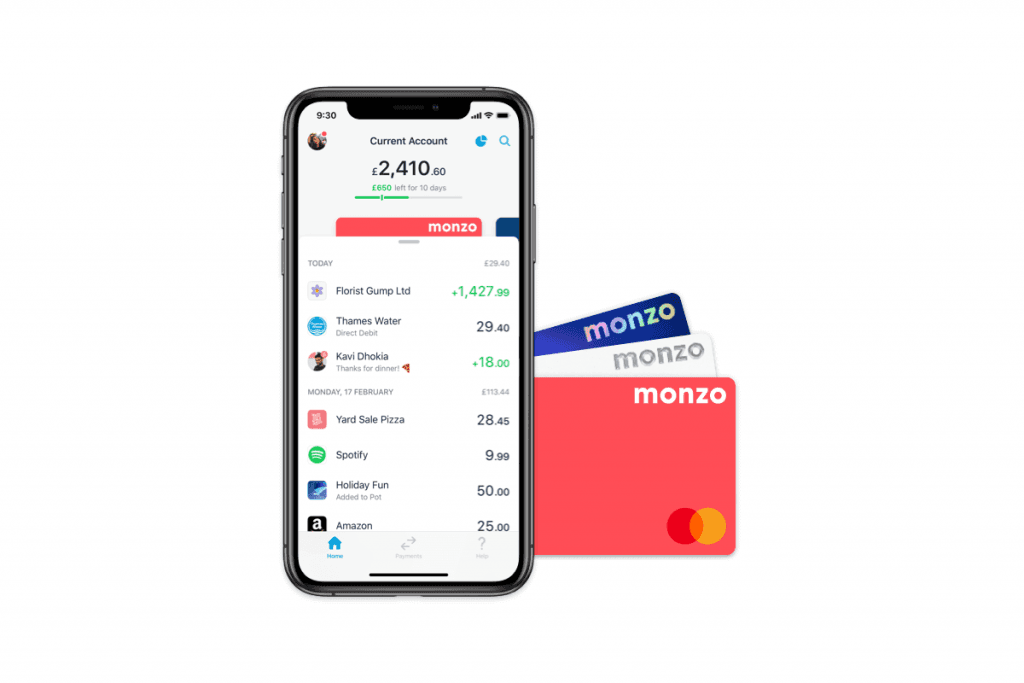

Monzo

Monzo began life in 2016 as a prepaid Mastercard offering, which worked in correlation with their mobile app. Early benefits included free cash withdrawals abroad and an easy way to top up your account through the app.

It didn’t take long for Monzo to obtain its banking licence, achieving this in April 2017. Since then, the bank has grown exponentially and now boasts over 4 million customers.

Services they offer:

Personal, joint and business current accounts

Interest on savings pots

Overdrafts

Compatible with Apple and Google Pay

Personal loans

Get your salary or student loan paid a day early

Cash deposits through Paypoint (charges apply)

Energy Switching

No fees when spending on a Monzo card abroad

Regulated and authorised by the FCA and FSCS up to £85,000.

Reviews:

7,479 reviews on Trustpilot. Excellent (80%) and Great (5%) account for 85% of the votes.

App Store: rated 4.5* from 12.5k reviews

Google Play: rated 4.5* from 18k reviews

User Experience:

Monzo is another solid example of an app that makes managing your money much easier, actionable and - dare we say it - enjoyable. The signup process is completely managed within the app and it takes mere minutes to set up an account. Once logged into the app, users can immediately see the breakdown of spending, can access card details and overall, easily navigate to all the key functions you need.

Colour focused cues help users see at a glance how they are performing money-wise and allows them to make snap decisions around purchases or saving. Some icons are not as intuitive as they maybe could be but can be figured out quickly enough.

Finally, whilst not a technical feature as such, the strength of the customer service experience with Monzo positively adds to the overall user experience.

Standout feature:

The stand out feature within the Monzo app has to be the ability, within a couple of taps, to be paid your salary or student loan a day earlier.

Whilst this may not be something we need to use all that often, the fact it is there and - like most things in Monzo - is easy to navigate and use means we have another layer of security for our financial position.

Potential for improvement:

It appears a number of users have all commonly experienced issues with email verification of their account and gaining access to the app/their accounts if they have changed devices. Taking into account how often people upgrade their devices to keep up with the latest tech, this is something to keep an eye on.

In the way of enhancements as opposed to fixes, the application has an opportunity to provide better insights into the spending habits of its users. Whilst the app enables a user to see how much they have spent in a particular month and what on, this could be improved. A higher level report or dashboard tracking the trend of your habits over time, which the user can then filter by category or supplier etc. would be a good example of further insight and intuitiveness.

Furthermore, the ability to multi-select transactions to change their tags would save a lot of time.

Summary:

Monzo has achieved significant growth over the last few years, which has ultimately been fuelled by word of mouth - testament in itself to the strength of the app and its service.

Great budgeting features, an easy to navigate the app and solid customer support have enabled people to recommend them in confidence. They are starting to bring other services into the mix with their savings offerings and energy switching service, which shows they are continually looking to bring new innovative features.

As well as continuing to innovate, there is potentially an opportunity for Monzo to further improve the user experience of their app by looking into their verification/access processes and by better leveraging the data stored in the app to provide more insights.

Atom Bank

Atom bank was the first digital-only bank to obtain a banking licence whilst being entirely based around a mobile application. It was a pioneer in moving away from passwords and using voice and facial recognition. What’s more, Atom has taken a different tact to many of its Digital rivals, rather than focusing on current accounts it offers savings accounts and mortgages.

They have previously been crowned the ‘Best Online lender’ at the What Mortgage? Awards, the Most trusted UK bank on Trustpilot and at the end of 2019, Atom ranked 2nd in business analyst Beauhurst's list of 50 top fintech UK startups and scale-ups; one of only four companies from outside London in the entire top 50.

Services they offer:

A range of fixed saver accounts

Higher interest than many rivals

A range of fixed-rate mortgages

Business loans

Regulated and authorised by the FCA and FSCS up to £85,000.

Reviews:

3,343 reviews on Trustpilot. Excellent (79%) and Great (14%) account for 93% of the votes.

App Store: rated 4.6* from 7.7k reviews

Google Play: rated 4.1* from 1.1k reviews

User experience:

Atom bank historically has always had a good user interface and experience, especially on Apple devices, however, they haven’t rested on these laurels.

Instead, they have recently revitalised their application in order to make it even more customer-centric and to keep up to speed with an increasingly competitive space. You can understand more about this redesign here.

The sign-up process is slick and you get a feel for the in-depth security of this application as you progress through into the core of the app. Information is presented clearly.

It is easy for the user to see exactly what savings products are available to them, the terms of the products and importantly, what amount they will actually save over the term of their agreement.

Standout feature:

The stand out feature when it comes to Atom is the security.

When it comes to our finances, is there anything that we question more than “is it safe?”. Well with Atom, this is something that is put at ease right from the off. As part of the sign-up process, you are requested to not only enter a passcode but to set up voice and face recognition. This extra layer of biometric security is a welcome comfort blanket!

Potential for improvement:

It is therefore ironic that the standout feature is also seemingly its current Achilles’ heel. The facial recognition measure, whilst offering a comfort blanket, is also a source of frustration for some users.

It’s clear from user feedback that this feature is somewhat inconsistent at present, in terms of actually working/recognising the individual. With this being a blocker for both new customers wanting to sign up and existing users accessing their accounts, it is certainly an area for improvement.

Summary:

It is safe to say Atom bank was one of the pioneers in the digital banking field.

They took a slightly different approach to many others, made it work and continue to deliver a great service. Their use of voice and biometrics offers a nice, tech-focused alternative to classic security methods.

On the whole, their app is well-designed and enables a smooth user experience. It is clear, however, there are some inconsistencies with the biometric element which are holding some users back. Looking at the communication from Atom though, this feedback from users has been taken on board, so let's see if those ratings rise.

Monese

Monese, like many of the other banks, was born out of frustration and personal experience. Only there was a slight difference in this instance.

In 2014, Monese founder Norris Koppel moved from Estonia to the United Kingdom. He had no immediate proof of address or UK credit history, which made it impossible for Koppel to open a bank account. This in turn inhibited him from being able to rent or receive a salary.

As a result, mobile-centric Monese was launched in 2015 and enabled people to create an account without a UK address. Monese has won several awards including Best Challenger Bank and now boasts over 2 million customers.

Services they offer:

Current accounts for both GBP and EUR

Varied benefits depending on subscription

Real-time budgeting and notifications

Business accounts

Cash deposit and withdrawals through the Post Office or Paypoint (charges apply)

Compatible with Apple and Google Pay

Feeless spending or withdrawals abroad.

Partnership with Avios

Regulated and authorised by the FCA but not FSCS.

Reviews:

15,182 reviews on Trustpilot. Excellent (76%) and Great (11%) account for 87% of the votes.

App Store: rated 4.8* from 27.8k reviews

Google Play: rated 4.5* from 35k reviews

User experience:

Monese has developed a wonderfully clean and simple user experience for their application. The navigation and flow throughout the app are well thought out and it’s easy to move between your various accounts/different currencies.

All the icons are self-explanatory, the colours of the brand are permeated throughout the app and it feels sophisticated but not too corporate.

Finally, for an app that enables users to manage various currencies, it is great that the application is supported and available across many different languages.

Stand out feature:

The stand out feature for Monese absolutely has to be the ability to sign up for an account without proof of an address. This will enable so many people, new to the UK, to manage their finances from the get-go.

In order to keep on par with the other reviews in this article, however, the standout feature of the application itself is the integration with Avios. Easy to set up within the app and once linked, any spending on your Monese card, with one of the retailers covered in the Avios partnership, is automatically registered and relevant points accrued and added.

Potential for improvement:

The opportunity for improvement with this application is not related to a particular standalone feature but is instead a wider experience: customer service. As one user terms it: ”Appalling customer service, otherwise decent app”.

Whilst customer service is absolutely an operation in itself and incorporates many parts and processes outside of the application itself, it is also one that could be better supported by the application.

Frustrations with onboarding could potentially be eased by revisiting the current process within the app. Likewise, customer support response times could be reduced by an improved chat service within the app or more interactive troubleshooting features.

Summary:

Whilst there is an opportunity for Monese to further improve their customer experience, it is clear that on the whole they offer great services and enable people all over Europe to open accounts easily where in the past they may have struggled. They could leverage user research to really understand what their customer needs here.

The mobile application itself is clean and intuitive. Some users did mention that the app didn’t make the best use of screen real estate on the latest, larger devices but Monese are already progressing with an update for this.

If you need a bank account, which will readily move with you to new pastures in the UK and Eurozone, it is hard not to consider Monese.

Revolut

Revolut was founded in 2015 by Nikolay Storonsky and Vlad Yatsenko. Between Storonsky and Yatsenko there was a wealth of experience with financial systems and services. The offering started out as a prepaid card and mobile app which enabled travelling users to efficiently switch between currencies.

Since then, Revolut has grown rapidly both in customers and features. The digital banking alternative now has over 8 million customers and in early 2020, became the UK’s most valuable fintech company.

Services they offer:

Personal and business current accounts.

Real-time budgeting and notifications

Joint saving vaults (an alternative to joining accounts)

International payments and spending are fee-free

Compatible with Apple and Google Pay

Perks and rewards on the standard accounts

Trade stocks, commodities and cryptocurrencies

Get device and travel insurance in-app

Approved by the FCA but not covered by FSCS (Revolut was granted a European banking licence by the Bank of Lithuania in 2018, but in the UK has operated as an FCA authorised e-money institution)

Reviews:

62,506 reviews on Trustpilot. Excellent (78%) and Great (12%) account for 90% of the votes.

App Store: rated 4.8* from 14.6k reviews

Google Play: rated 4.7* from 706k reviews

User experience:

This app provides a user experience, best described as an intuitive, mini-universe. It manages to combine a feature-packed application with a user friendly, easy to navigate design.

From bigger features such as the ability to trade stocks and donate to charities within the app, right down to the simple touch of having an in-app currency converter, this app provides you with a varied service and a wholesome user experience.

Stand out feature:

The stand out feature for Revolut could actually be the wealth of features it offers but if one had to be crowned, bearing in mind Revolut’s backbone of being an account of choice for travelling abroad, it has to be the ability to get travel insurance from within the app itself.

Like many of the services accessible within Revolut, you are not transferred to other sites or apps to manage transactions, you can instead book your travel insurance quickly and easily from within the app itself.

Potential for improvement

From the app side of things, the reviews are a testament to how strong Revolut’s application is, however, for the paid accounts there are some calls in the user community for even more features.

The challenge for Revolut is to continue to innovate their banking experience and ecosystem, but then to also consider how they manage this within the real-estate of the application itself. Lots of features are great but if the app begins to feel cluttered or overwhelming then this is a sure way to lose users. Maybe they could allow users to select what features they see within the app?

Summary:

In summary, Revolut is a very compelling alternative to traditional banking, especially if you have a need to utilise multiple currencies or travel/holiday abroad often due to its interbank exchange.

The app is sophisticated, clean, offers plenty of useful features and information. Revolut is surely only going to continue to grow once it overcomes the hurdle of officially being a bank and covered by the FSCS in the UK. They will, however, need to keep innovating and adding unique features to stay competitive in an ever-adapting, super-fast-moving landscape.

The overall verdict

The 5 banking applications in this article are undoubtedly 5 of the best available in the UK at the present time and they all offer intuitive, insightful ways for us to manage our finances.

This battleground is becoming ever increasingly competitive, the likes of Curve and Transferwise could readily take a spot in this list. Looking slightly further afield, this competition grows, you have N26, a renowned European digital bank that only recently stopped offering accounts in the UK, or Doconomy, who have taken a superb environment-focused approach to digital banking.

The beauty of all of this, from a user and consumer perspective, is the element of flexibility and choice.

We are no longer restricted or tied to particular banks or service providers. At present, many people are utilising this opportunity to take advantage of the best of both worlds: the main account from a traditional bank (for assurance and face-to-face interactions) with one or more digital accounts (for easier, on-demand financial management). To make things even easier to manage, plenty of people then choose to wrap this all up into ‘one card to rule them all’ through Curve.

This does though spark some further questions: what do digital-only banks need to do to become everyone's primary account? How can they keep their users engaged with their platforms in such a competitive space?

Some of the answers are already there. Make sure customer support is red-hot, so people don’t feel like they need the comfort of a branch. Make sure the application provides an enjoyable, enriching user experience that enables the user to manage their finances as they need to. Offer all of the services traditional banks do and more. Oh, and a flashy card seems to go down a treat as well!

Got an idea? Let us know.

Discover how Komodo Digital can turn your concept into reality. Contact us today to explore the possibilities and unleash the potential of your idea.

Sign up to our newsletter

Be the first to hear about our events, industry insights and what’s going on at Komodo. We promise we’ll respect your inbox and only send you stuff we’d actually read ourselves.