How Investing In Better Fintech Onboarding Pays Dividends For Your ROI in 2024

UI/UX Design

User Research

Onboarding is the process of integrating a user with your app or software. You do this by gathering data on their needs and familiarising them with the key functions of your product. In Fintech, onboarding is crucial to both your app’s success and your business’s integrity. In this article, you’ll learn:

The importance of onboarding in Fintech

How to improve an existing onboarding journey with user research

How to design a better onboarding journey from scratch

As a product studio that specialises in both revamping the trajectory of your existing technology in our Refinement track or launching something new through Revolution, we are actively engaged in the Fintech sector and wanted to share our insights here.

Fintech is a lucrative industry for big brands and emerging startups alike. Fintech businesses have received enormous investments over the past decade. And despite a brief slowdown period due to the COVID-19 pandemic, peaked at 226.5 billion USD in 2021. Fintech’s popularity is mainly due to its necessity. As consumers adopt more digital products, banks and challenger brands have launched more ways to support customers with financial products. From banking to investment, managing your finances is now so easy. Made possible by the efforts of fintech developers and tech entrepreneurs. Tasked with building technology that protects users’ data and privacy whilst offering intuitive experiences and interfaces. Fintech brands must do everything they can to keep their customers happy or face dissatisfaction, abandonment or even financial action. Building the tech isn’t enough. In fintech, the onboarding process for your technology is crucial to your success. Not only in terms of customer appeal, but also for security and privacy purposes.

Catrin Orr, UX/UI Designer at KOMODO, reinforces the need for a clear, safe onboarding process to prevent customer abandonment and potential legal challenges. “I think with Fintech it's important to make the language used during onboarding as accessible and transparent as possible. Both by avoiding financial and technical jargon and always explaining why certain information is needed from the user, especially if it's sensitive data.” Considering a recent case in which the Plaid app was forced to pay over $58 million for data privacy concerns, you simply cannot afford to take risks.

What is onboarding in Fintech?

Onboarding refers to a series of steps that a user must take when they first use an app. For some applications, onboarding can be as simple as a quick user registration – while for others – it must be more in-depth and tutorial-driven. In the fintech world and specifically in banking, great technology has had a sizeable impact on users’ lives. It reduces much of the friction associated with traditional banking or finance processes. Traditional banking requires lots of input from the user to visit the bank, submit documentation, prove their identity and fill out forms etc. In an ideal world where onboarding goes well, your fintech app should reduce these traditional frustrations and cut down a user’s time commitment. Fintech occupies a unique position in the onboarding world. As a user begins to interact with your product, you must balance your need to capture unique user data against the highest standards of security and privacy. Essentially, fintech onboarding means collecting enough user data to make the app experience more tailored, but without frustrating the user or exposing them or your business to any external risk. Typically, you’ll need to use onboarding to:

Gather key user data such as location and date of birth

Verify customer identity via KYC

Demonstrate features and functionality

Ultimately, the goal of your onboarding process is to unlock the ‘aha’ moment for your customer. You want them to have a genuinely positive reaction to an input or choice they’ve made. In Fintech specifically, this must balance against security and compliance concerns.

The importance of good onboarding in fintech

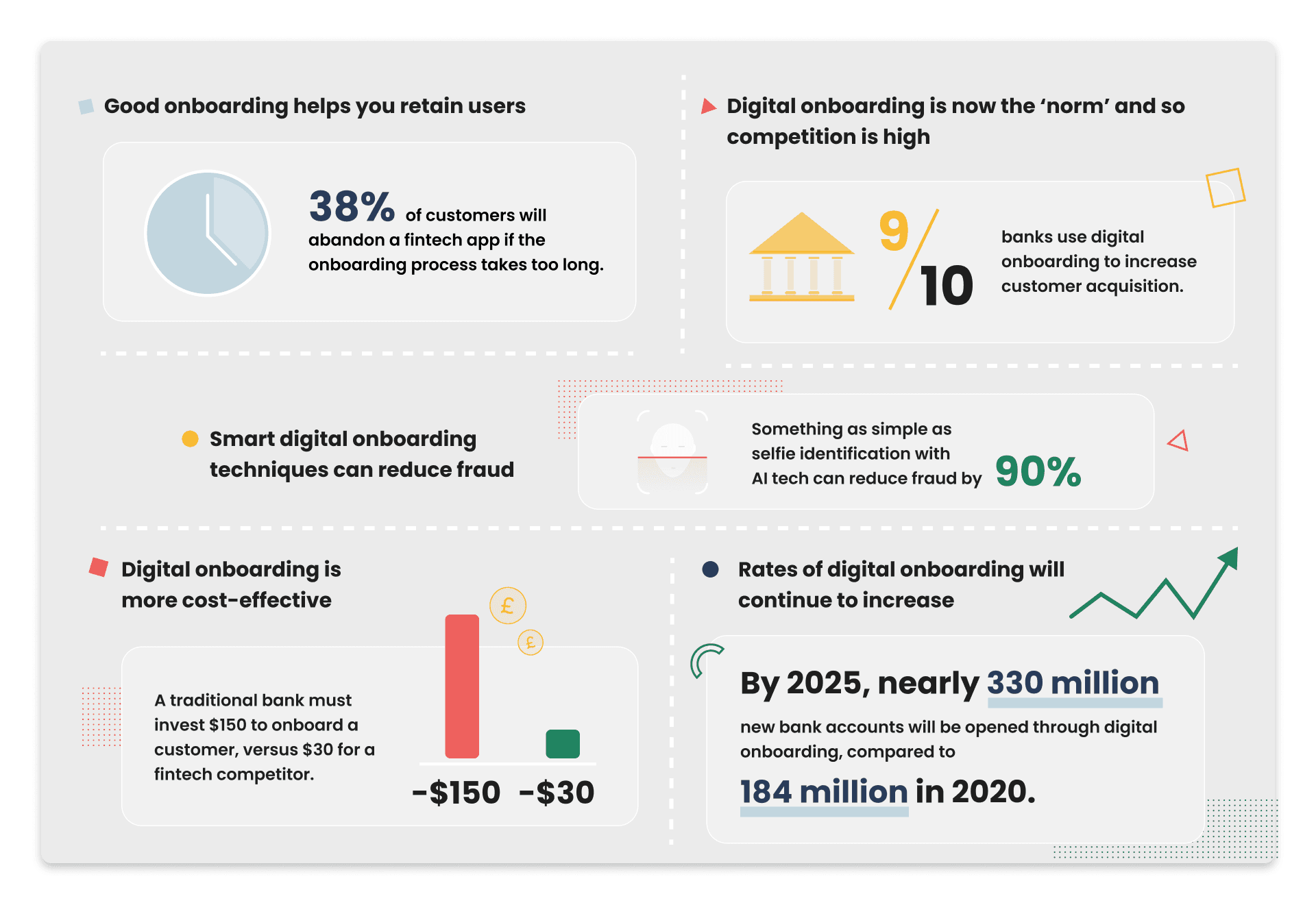

Good onboarding helps you retain users: 38% of customers will abandon a fintech app if the onboarding process takes too long.

Digital onboarding is now the ‘norm’ and so competition is high: 9 out of 10 banks use digital onboarding to increase customer acquisition

Digital onboarding is more cost-effective: A traditional bank must invest $150 to onboard a customer, versus $30 for a fintech competitor

Rates of digital onboarding will continue to increase: By 2025, nearly 330 million new bank accounts will be opened through digital onboarding, compared to 184 million in 2020.

Smart digital onboarding techniques can reduce fraud. Something as simple as selfie identification with AI tech can reduce fraud by 90%.

Let’s take a detailed look at how you can build a better fintech onboarding experience that wins customers and keeps you compliant.

The concepts behind great fintech app onboarding

To design optimal onboarding experiences in fintech, remember to anchor your product around some core strategic design concepts:

Clear: it should be clear and accessible to all

Streamlined: the faster you can onboard a customer, the better

Secure: all data and privacy information must be protected

Personalised: where possible, onboarding should be designed around specific user types and groups

Compliant: your onboarding process must meet the compliance standards expected by the regulators in your geographic area such as e-KYC, AML5 and the eIDAS Act.

Fundamental UX onboarding concepts

Before digging into data or customising for specific users, establish the best practices for onboarding. Our team audited the most popular Fintech apps to create a baseline of concepts shared by these apps. Review your own onboarding process against these ideas and see how well you compare:

Prioritise a user’s time and attention by designing onboarding to be as simple and clear as possible.

Allow a way out of any onboarding process and make sure how to exit is obvious.

Explain why you need each piece of information and don’t request anything that isn’t necessary to your app.

Consider using benefit-based onboarding. Simply show the value of the app to users and how it benefits them during the onboarding process.

Ensure you’re compliant with standards such as Know Your Customer (KYC) and Anti Money Laundering (AML).

Use security and safety features that users are already familiar with and trust. Try two-factor authentication, automatic logout, captcha etc.

Display a visual indicator of progress to prevent burnout or abandonment. A progress bar or checklist is helpful.

One of our UX team even suggests starting the progress bar at 10% to stimulate satisfaction. This works because you’ll already have some basic information about the user. Just carry through whatever information you have from when they download the app.

However, be aware that some gamified progress bars can lead to user frustration. Our head of UX, James Tabiner, reminds us that: “gamification is interesting. It works to some extent, but it just annoys me more than anything. If my profile isn't 100% complete and the app is telling me that – I'll complete it. Not because I want to but because I can't bare it being at like 74% or some horrible number like that. So it works, but the intended behaviour probably isn't to make me hate it."

Where complex flows are required, ensure there are visual walkthroughs or demonstrations that guide users through the process. These walkthroughs should be replayable, cancellable and repeatable at any point during onboarding.

The end goal of all of these steps is the same: Design an experience which establishes value but prioritises trust through security.

Seek the ‘aha’ moment

Discussions around customer fintech onboarding often mention the ‘aha’ moment. The moment when a user ‘gets’ the value you are offering and even delights in their interaction. While it may seem like farfetched thinking to want your users to get excited about their banking app, you must remember that the ‘aha’ moment is also about sudden comprehension. It’s the point at which they feel capable of using your app. For a fintech market, designing simple form completions or one-click tasks that can satisfy this concept of capability will be the more effective approach than chasing novelty. Some designers describe this idea as building the ‘time to value’, or TTV, which is the time it takes for a user to grasp value. As part of your design process, you should be trying to establish what the ‘aha’ moment looks like. Then optimise it to shorten your TTV process to maximise user engagement.

Tailor onboarding via user research

One of the main powers of digital technology is that it provides genuine, data-driven insight into customer behaviour. It removes the need for speculation or overreliance on purchased third-party research. Even if you’re yet to launch an app, you’ll likely have an asset that collects user data like a website or a social media page.

All of these sources of data will enhance your onboarding experience. When you have access to unique data, you can design more specifically to meet each audience’s needs. Looking into your data even allows you to spot moments of frustration and abandonment, which you can then feed back into the project roadmap to help reduce friction. However, these abandonment points aren’t always clear through data alone. It may be worth investigating them further through tailored user research.

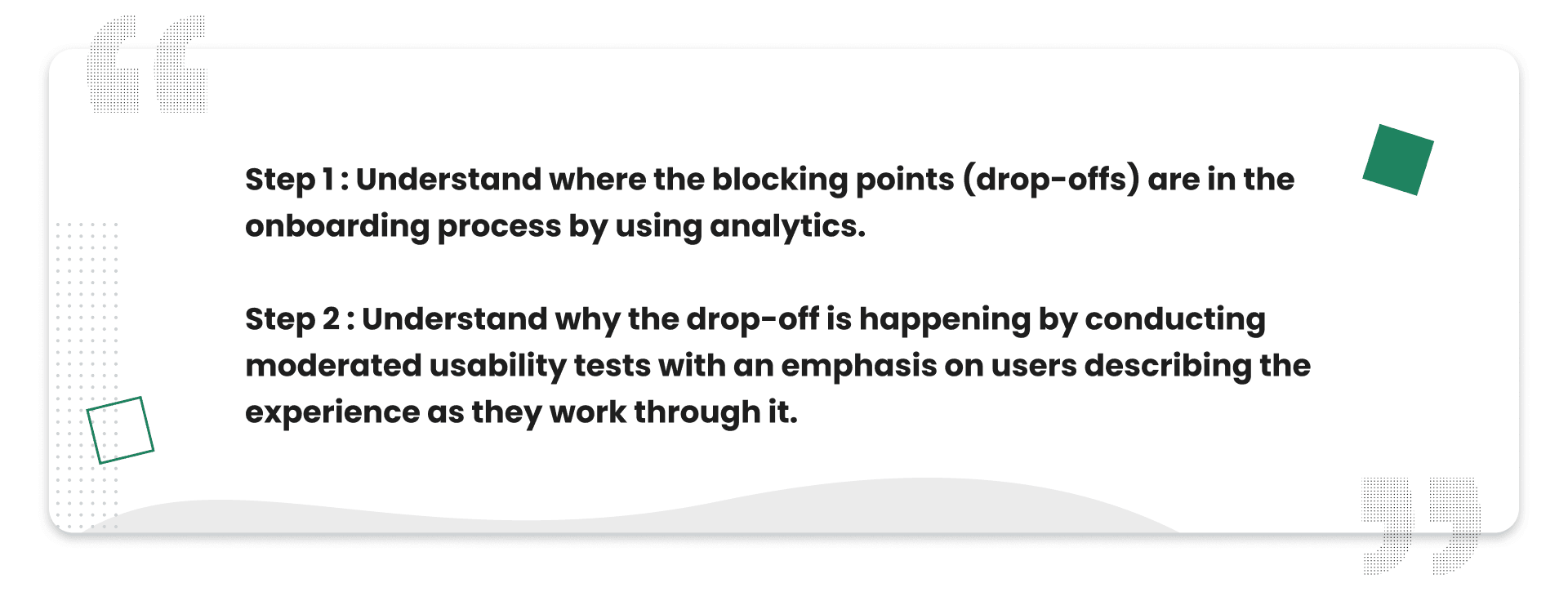

Dr Shaun Jerdan, Senior User Researcher at KOMODO: “Step 1 — Understand where the blocking points (drop-offs) are in the onboarding process by using analytics. Step 2 — Understand why the drop-off is happening by conducting moderated usability tests with an emphasis on users describing the experience as they work through it.” As Dr Shaun explains in the quote above, finding the drop-off points is only one part of the journey. While your data may tell you when a user is dropping off, usability tests will help you extract why users are losing interest. In Fintech, the depth of your user research may be restricted by compliance and data privacy rules, but you can still extrapolate key user types and their journeys. By using analytics, you add authority to your estimations and build a more robust idea of what users are doing in your ecosystem. This becomes doubly important in the next step…

Personalised onboarding based on user type

Once you have a better idea of your user's behaviours, you must customise your onboarding experience based on user type. Consider designing specific user flows for each user type and behaviour. For example, have a specific short flow for a younger, more tech-savvy user. Change tact for an older, less technical user with a more “handholding” approach.

A lack of user personalisation is a glaring issue for many Fintech apps. James Tabiner, Head of UX at KOMODO suggests it could be the most impactful change you can make: “So, one design consideration I think people need to include more in their onboarding is making an app’s onboarding experience contextual. It's not always a one size fits all experience. Providing a slightly different onboarding experience depending on user type can be a very powerful way to retain that user throughout the onboarding flow and into the app. Ask some initial questions to decipher the user type then show the user the main functionality of the app, but in the context of their user type. This is not only a nice way to onboard them, but it also helps engage and retain the user.” Customisation doesn’t mean EVERY part of the onboarding journey should be unique. One common feature that should be shared is the ability to skip parts of the onboarding process, especially during ‘tour’ moments. There must always be a ‘way out’ of the process even when it’s highly customised.

Gather information more efficiently

General digital onboarding is as much about engaging your user with the product as it is about gathering key information. For customer onboarding in Fintech, there’s a specific onus placed on your business to gather the right information to meet compliance requirements and to ensure safety and privacy. Digital tools have transformed onboarding. It reduces the need to visit the bank etc, but also protects businesses and users alike against fraud and money laundering. Newer capabilities such as selfie uploads to act as identity verification have slashed fraud rates, but are less familiar to users and may be met with doubt. Onboarding’s role is to help alleviate that doubt and ensure the user uploads the selfie and completes the verification process. Know Your Customer (KYC) regulations are always changing. It is leading to more and more information being required from the customer in what can be a laborious and frustrating process. A smart onboarding journey helps alleviate the fear and doubt caused by KYC – as long as you can request only the most crucial information at the start and then later. When a user is more comfortable with your technology, you can begin capturing other information and tailoring your requests around the user’s needs. There is a hierarchy of information required by Fintech businesses which varies based on your company but always shares a certain level of user doubt/frustration. Standard personal details such as name and DOB are common and unlikely to cause hesitation. However, as you begin to request more specific qualifying information such as financial position etc and perform credit checks, a user is more likely to exit the onboarding journey. To make this process easier, always request ONLY the most essential information. Make sure that you always show tips as to why you need it or what it will be used for. For example, when asking for a selfie upload have a tooltip that explains I.D verification and how it benefits the user (less time waiting, no need for physical mailing of passports etc, fraud prevention.)

Summarising an ideal Fintech onboarding experience

You’ve learned what onboarding is, why it’s vital to the growth of Fintech and how to design better experiences based on user needs. If you’ve skimmed through this article or you just want a reminder, let’s recap the most important points here:

Define user needs through a combination of data and user interviews.

Find the ‘aha’ moment you want a user to encounter and design around that.

Design an onboarding experience that minimises frustration by removing unnecessary information requests.

Consider a progress bar or indicator and allow users to exit at any time.

Include a pre-completed task when onboarding begins to encourage users.

Put users with different goals on different paths – each flow should be specific to a user type.

Show feature tips in context and explain key information requests where needed.

Overview

Here at KOMODO, our creative product studio supports Fintech businesses in designing better app technologies that encourage user interaction, dispel doubts and reduce dropout. If you’d like to work with us, why not book a call to discuss your needs?

Got an idea? Let us know.

Discover how Komodo Digital can turn your concept into reality. Contact us today to explore the possibilities and unleash the potential of your idea.

Sign up to our newsletter

Be the first to hear about our events, industry insights and what’s going on at Komodo. We promise we’ll respect your inbox and only send you stuff we’d actually read ourselves.